Baxter Reports Third-Quarter 2017 Results and Updates Financial Outlook For Full-Year 2017

Third-Quarter Revenue of $2.7 Billion Increased 6 Percent on Both a Reported and Operational Basis

Third-Quarter GAAP Earnings Per Share (EPS) of $0.45; Adjusted EPS of $0.64 Increased 14 Percent

Expects Full-Year 2017 Sales Growth of 4 Percent on a Reported Basis and 4 to 5 Percent on an Operational Basis

Expects Full-Year 2017 GAAP EPS of $1.85 to $1.93; Raises Adjusted EPS to $2.40 to $2.43

Deerfield, Ill. -

Baxter International Inc. (NYSE:BAX) today reported results for the third quarter of 2017 and updated its financial outlook for full-year 2017.

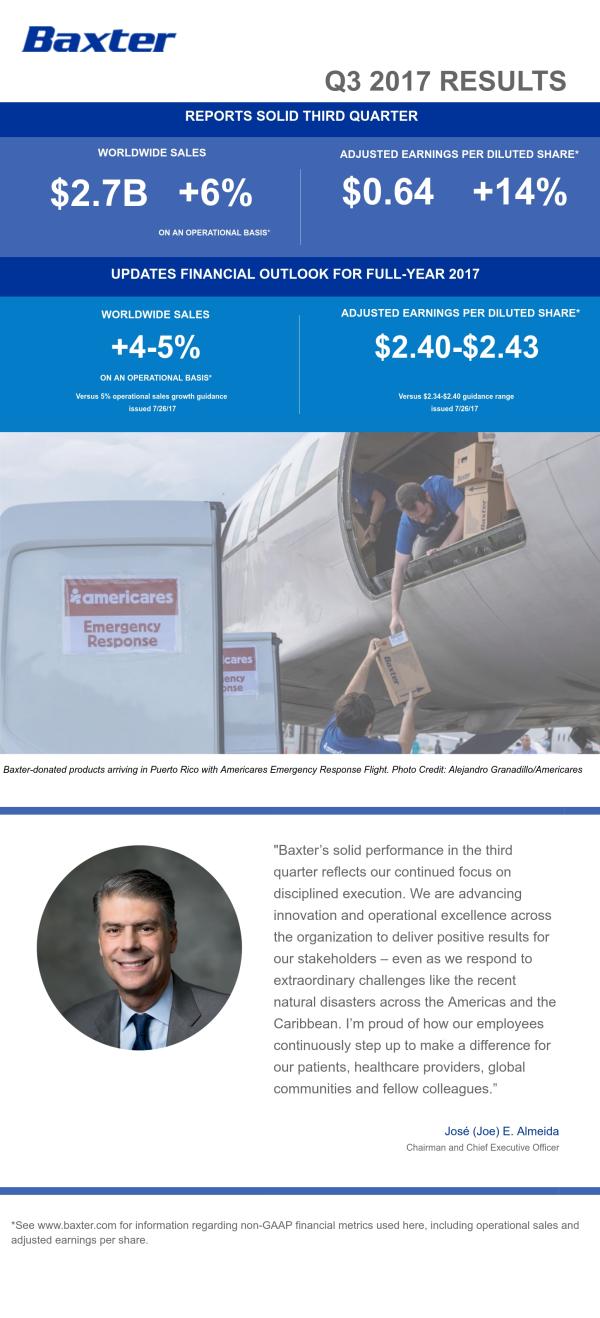

“Baxter’s solid performance in the third quarter reflects our continued focus on disciplined execution,” said José (Joe) E. Almeida, chairman and chief executive officer. “We are advancing innovation and operational excellence across the organization to deliver positive results for our stakeholders – even as we respond to extraordinary challenges like the recent natural disasters across the Americas and the Caribbean. I’m proud of how our employees continuously step up to make a difference for our patients, healthcare providers, global communities and fellow colleagues.”

Third-Quarter Financial Results

In the third quarter, worldwide sales totaled $2.7 billion, an increase of 6 percent on a reported, constant currency and operational basis as compared to the prior-year period. Operational sales adjust for the impact of foreign exchange, generic competition for U.S. cyclophosphamide, the Claris Injectables (Claris) acquisition and the previously communicated select strategic product exits the company is undertaking.

Sales within the U.S. were approximately $1.1 billion, advancing 8 percent. International sales totaled approximately $1.6 billion, representing a 5 percent increase on a reported basis and a 4 percent increase on a constant currency basis. Baxter’s operational sales rose 7 percent in the U.S. and 6 percent internationally.

Global sales for Hospital Products totaled $1.7 billion in the third quarter, advancing 7 percent on both a reported basis and constant currency basis and 6 percent operationally as compared to the prior-year period. Performance in the quarter benefited from continued strength in our U.S. fluid systems business as well as favorable demand for injectable pharmaceuticals reflecting a contribution of approximately $27 million of sales from the July 27 acquisition of Claris. Sales in the quarter also benefited from increased sales of anesthesia and critical care products as well as hospital pharmacy compounding services.

Baxter’s third quarter Renal sales were approximately $1 billion, representing an increase of 3 percent on both a reported basis and constant currency basis. Operationally, Renal sales advanced 6 percent in the quarter driven by improved performance across all major product lines and therapies globally.

Baxter reported income from continuing operations of $248 million, or $0.45 per diluted share, on a GAAP (Generally Accepted Accounting Principles) basis for the third quarter. These results included special items totaling $149 million ($108 million net after-tax), primarily related to business optimization, intangible asset amortization, product-related reserves, Claris integration expenses and Puerto Rico-related expenses post Hurricane Maria.

On an adjusted basis, excluding special items, Baxter’s third quarter income from continuing operations totaled $356 million, or $0.64 per diluted share, exceeding the company’s previously issued guidance of $0.58 to $0.60 per diluted share.

Business Highlights

In support of its strategy to accelerate profitable growth and deliver meaningful innovation for patients and healthcare professionals around the world, Baxter has achieved a number of recent operational, pipeline and commercial milestones.

- Completed the acquisition of Claris Injectables Limited, a global generic injectables pharmaceutical company. The transaction significantly broadens Baxter’s presence in the generic pharmaceuticals space. Baxter is in the process of fully integrating Claris into its systems.

- Enrolled the first patients in two new clinical trials for a unique expanded hemodialysis (HDx) therapy enabled by THERANOVA. HDx therapy extends the range of molecules that can be cleared from the blood during hemodialysis (HD), resulting in a clearance profile that more closely mimics the natural kidney.1 The U.S. trial will support submission for marketing authorization from FDA. THERANOVA is currently available in several markets worldwide, including Colombia, where the company also launched a second multi-center, prospective trial of the technology. These efforts are part of Baxter’s growing investment in generating compelling scientific evidence supporting the approval of and access to innovative therapies.

- Launched the first 3-in-1 set for use in continuous renal replacement therapy (CRRT) and sepsis management protocols in select markets across Europe, Middle East and Africa. With this new indication, the oXIRIS set, which is used on the company’s leading PRISMAFLEX system, can now be employed to help remove excessive levels of cytokines, endotoxin and other inflammatory mediators from a patient’s blood.

Puerto Rico Update

In follow up to the company’s Oct. 12 press release, Baxter remains in limited production across all three manufacturing sites in Puerto Rico and is continuing to work with infrastructure providers to advance reliable restoration activities for power, communications and transportation.

The company remains focused on helping ensure patients have continued access to the products and therapies they need. To this end, Baxter has been working with FDA and has recently been granted regulatory discretion for temporary special importation of certain products from Baxter facilities in Ireland, Australia, Canada and Mexico to help support product supply for the U.S. market. While these actions will help mitigate some of the projected shortfall in supply, they will not be adequate to fully bridge the gap in the fourth quarter.

2017 Financial Outlook

Baxter currently projects fourth quarter revenues to be negatively impacted by approximately $70 million due to the temporary manufacturing disruptions resulting from Hurricane Maria.

For full-year 2017: Baxter now expects sales growth of approximately 4 percent on a reported basis, approximately 4 percent on a constant currency basis, and approximately 4 to 5 percent operationally. Earnings from continuing operations, before special items, are now expected to be $2.40 to $2.43 per diluted share.

For the fourth quarter: The company expects sales growth of 4 to 5 percent on a reported basis, approximately 2 percent on a constant currency basis and 1 to 2 percent operationally. The company expects earnings from continuing operations, before special items, of $0.56 to $0.59 per diluted share.

Please see the schedules accompanying this press release for reconciliations between the projected 2017 operational sales and adjusted earnings per diluted share to the projected GAAP sales and earnings per diluted share.

A webcast of Baxter's third quarter conference call for investors can be accessed live from a link on the company's website at www.baxter.com beginning at 7:30 a.m. CDT on October 25, 2017. Please see www.baxter.com for more information regarding this and future investor events and webcasts.

About Baxter

Baxter provides a broad portfolio of essential renal and hospital products, including home, acute and in-center dialysis; sterile IV solutions; infusion systems and devices; parenteral nutrition; surgery products and anesthetics; and pharmacy automation, software and services. The company’s global footprint and the critical nature of its products and services play a key role in expanding access to healthcare in emerging and developed countries. Baxter’s employees worldwide are building upon the company’s rich heritage of medical breakthroughs to advance the next generation of healthcare innovations that enable patient care.

This release includes forward-looking statements concerning the company’s financial results, business development activities, capital structure, cost savings initiatives, R&D pipeline including results of clinical trials and planned product launches, and outlook for 2017 (including estimates regarding the proposed impact of Hurricane Maria on the company’s fourth quarter operations). The statements are based on assumptions about many important factors, including the following, which could cause actual results to differ materially from those in the forward-looking statements: demand for and market acceptance of risks for new and existing products, and the impact of those products on quality or patient safety concerns; product development risks; product quality or patient safety concerns; future actions of regulatory bodies and other governmental authorities, including FDA, the Department of Justice, the New York Attorney General and foreign regulatory agencies (including with respect to the granting of temporary importation approvals); failures with respect to compliance programs; future actions of third parties, including payers; U.S. healthcare reform and other global austerity measures; pricing, reimbursement, taxation and rebate policies of government agencies and private payers; the impact of competitive products and pricing, including generic competition, drug reimportation and disruptive technologies; global, trade and tax policies; accurate identification of and execution on business development and R&D opportunities and realization of anticipated benefits (including the acquisition of Claris Injectables in July 2017); fluctuations in supply and demand (including as a result of a natural disaster or otherwise); the availability of acceptable raw materials and component supply; the inability to create timely production capacity or other manufacturing supply difficulties; the ability to achieve the intended results associated with the separation of the biopharmaceutical and medical products businesses; the ability to enforce owned or in-licensed patents or the patents of third parties preventing or restricting manufacture, sale or use of affected products or technology; the impact of global economic conditions; fluctuations in foreign exchange and interest rates; any change in law concerning the taxation of income, including income earned outside the United States; actions taken by tax authorities in connection with ongoing tax audits; breaches or failures of the company’s information technology systems; loss of key employees or inability to identify and recruit new employees; the outcome of pending or future litigation; the adequacy of the company’s cash flows from operations to meet its ongoing cash obligations and fund its investment program; and other risks identified in Baxter’s most recent filing on Form 10-K and other Securities and Exchange Commission filings, all of which are available on Baxter’s website. Baxter does not undertake to update its forward-looking statements.